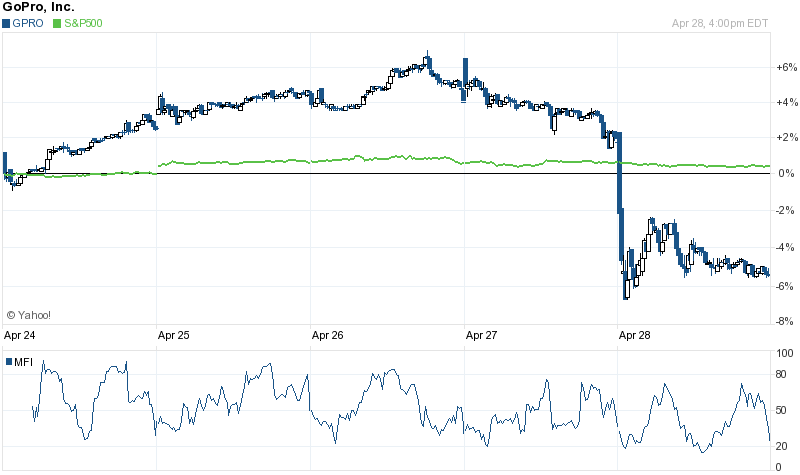

In a research note released on Sunday morning by Raymond James Financial, Inc. it was made clear that their underperform rating on shares of GoPro Inc (NASDAQ:GPRO) would not be changed.

Some other analysts have also published reports about the stock:

- Piper Jaffray Companies set a $8.00 target price on shares of GoPro and gave the company a sell rating in a research report on Saturday, February 4th.

- Barclays PLC restated an equal weight rating and issued a $10.00 target price on shares of GoPro in a research report on Friday.

- Oppenheimer Holdings Inc. restated a market perform rating on shares of GoPro in a research report on Friday.

- Robert W. Baird restated an underperform rating and issued a $6.00 target price on shares of GoPro in a research report on Friday.

- Wedbush restated a neutral rating on shares of GoPro in a research report on Friday.

There are mixed reviews on the stock, however the consensus looks to be that it is on the decline. Eight equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the stock. The company currently has a consensus rating of Hold and an average price target of $10.79.

GoPro (NASDAQ:GPRO) traded up 0.71% on Friday, reaching $8.57. 6,284,038 shares of the company traded hands. GoPro has a 52-week low of $7.14 and a 52-week high of $17.68. The firm’s market cap is $1.22 billion. The stock has a 50-day moving average price of $9.09 and a 200-day moving average price of $11.18.

GoPro (NASDAQ:GPRO) last issued its earnings results on Thursday, February 2nd. The company reported $0.29 EPS for the quarter, beating the consensus estimate of $0.22 by $0.07. The company earned $540.62 million during the quarter, compared to analysts’ expectations of $585.31 million. GoPro had a negative net margin of 35.35% and a negative return on equity of 44.14%. The business’s revenue for the quarter was up 23.8% compared to the same quarter last year. During the same period in the previous year, the company earned ($0.08) EPS. Analysts anticipate that GoPro will post ($0.17) earnings per share for the current fiscal year.

CFO Brian Mcgee sold 5,692 shares of GoPro stock in a transaction that occurred on Tuesday, February 21st. The shares were sold at an average price of $9.31, for a total transaction of $52,992.52. Following the sale, the chief financial officer now directly owns 91,250 shares of the company’s stock, valued at approximately $849,537.50. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Anthony John Bates sold 41,077 shares of GoPro stock in a transaction that occurred on Monday, March 6th. The shares were sold at an average price of $8.19, for a total transaction of $336,420.63. Following the sale, the director now directly owns 208,617 shares in the company, valued at $1,708,573.23. The disclosure for this sale can be found here. Insiders have sold a total of 84,668 shares of company stock worth $738,432 over the last ninety days. 28.69% of the stock is currently owned by insiders.

Many of the large investors have recently made changes to their positions in the stock.

- BlackRock Inc. raised its stake in shares of GoPro by 6.7% in the third quarter. BlackRock Inc. now owns 26,885 shares of the company’s stock valued at $449,000 after buying an additional 1,698 shares during the period.

- California State Teachers Retirement System raised its stake in shares of GoPro by 0.9% in the third quarter. California State Teachers Retirement System now owns 213,917 shares of the company’s stock valued at $3,568,000 after buying an additional 2,000 shares during the period.

- MSI Financial Services Inc raised its stake in shares of GoPro by 42.9% in the third quarter. MSI Financial Services Inc now owns 6,812 shares of the company’s stock valued at $114,000 after buying an additional 2,044 shares during the period.

- Wells Fargo & Company MN raised its stake in shares of GoPro by 2.3% in the third quarter. Wells Fargo & Company MN now owns 101,728 shares of the company’s stock valued at $1,697,000 after buying an additional 2,247 shares during the period.

- BlackRock Investment Management LLC raised its stake in shares of GoPro by 0.6% in the third quarter. BlackRock Investment Management LLC now owns 418,471 shares of the company’s stock valued at $6,980,000 after buying an additional 2,404 shares during the period. 33.16% of the stock is currently owned by institutional investors.

GoPro Company Profile

GoPro, Inc produces mountable and wearable cameras (capture devices) and accessories. The Company’s products are sold globally through retailers, wholesale distributors and on its Website. It enables people to capture compelling, immersive photo and video content of themselves in their day to day life, as well as participating in their favorite activities.